CD Specials

Elevate your return.

Earn higher dividends than a traditional savings account with our special certificate rates, available in terms ranging from 7 to 27 months!

Achieve your goals or cover the unpredictable with flexible funds.

Up to

Earn higher dividends than a traditional savings account with our special certificate rates, available in terms ranging from 7 to 27 months!

Choose from a rich lineup of credit cards – Visa® Platinum, Visa® Premier, and Visa® Elite – with low rates and no annual fee and all the rewards.

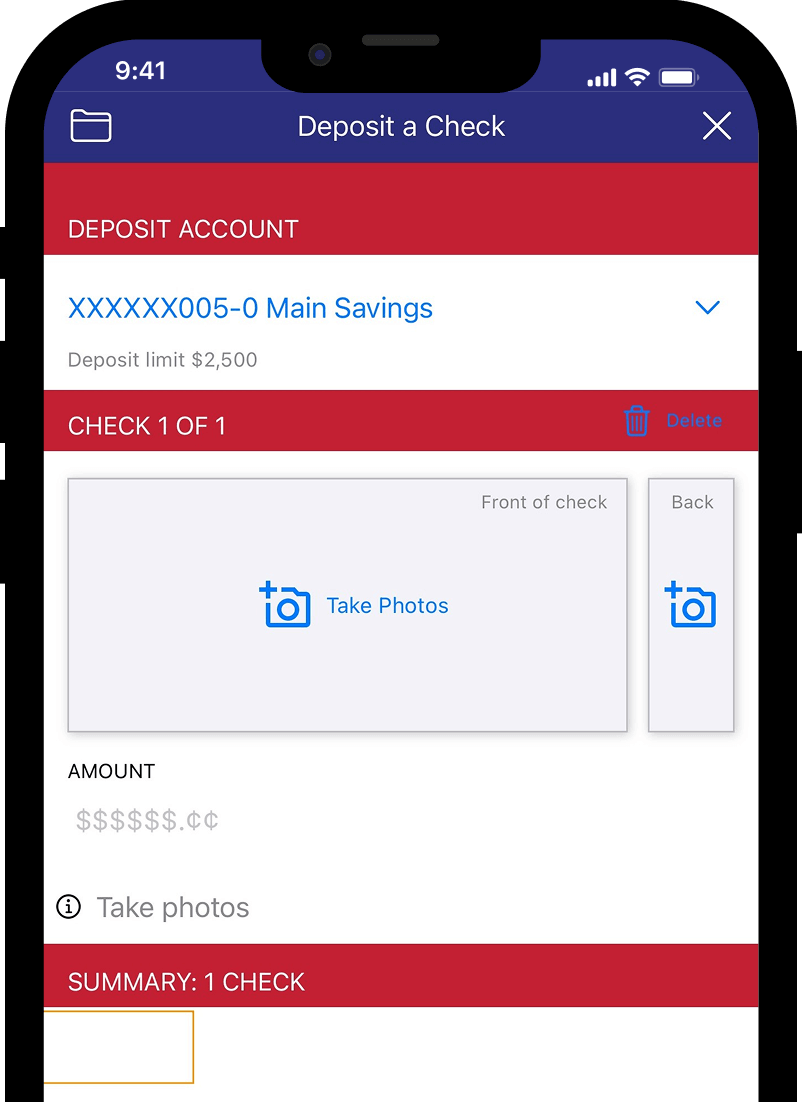

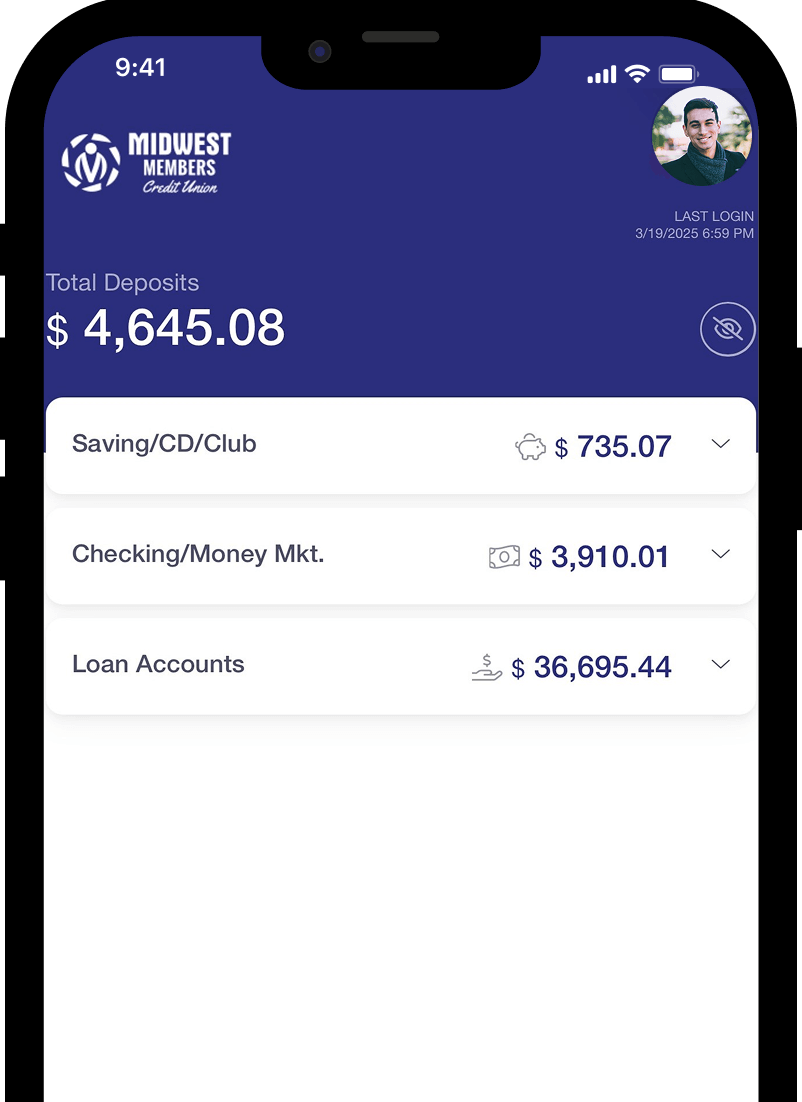

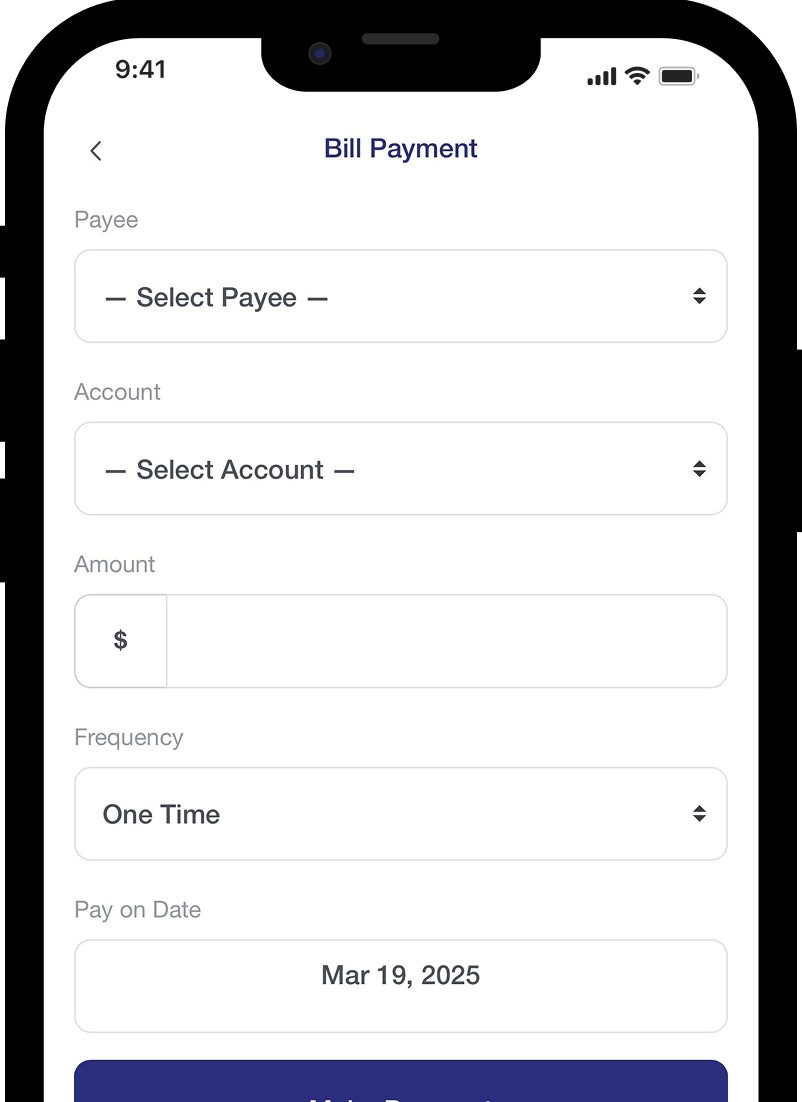

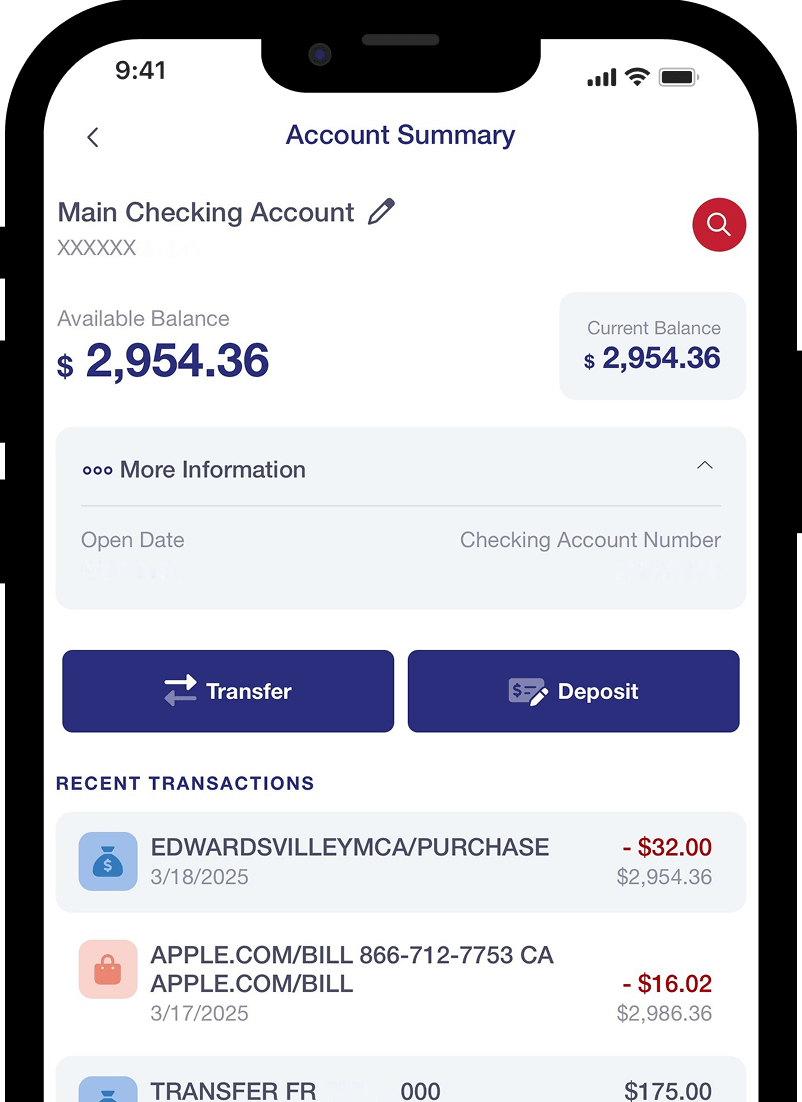

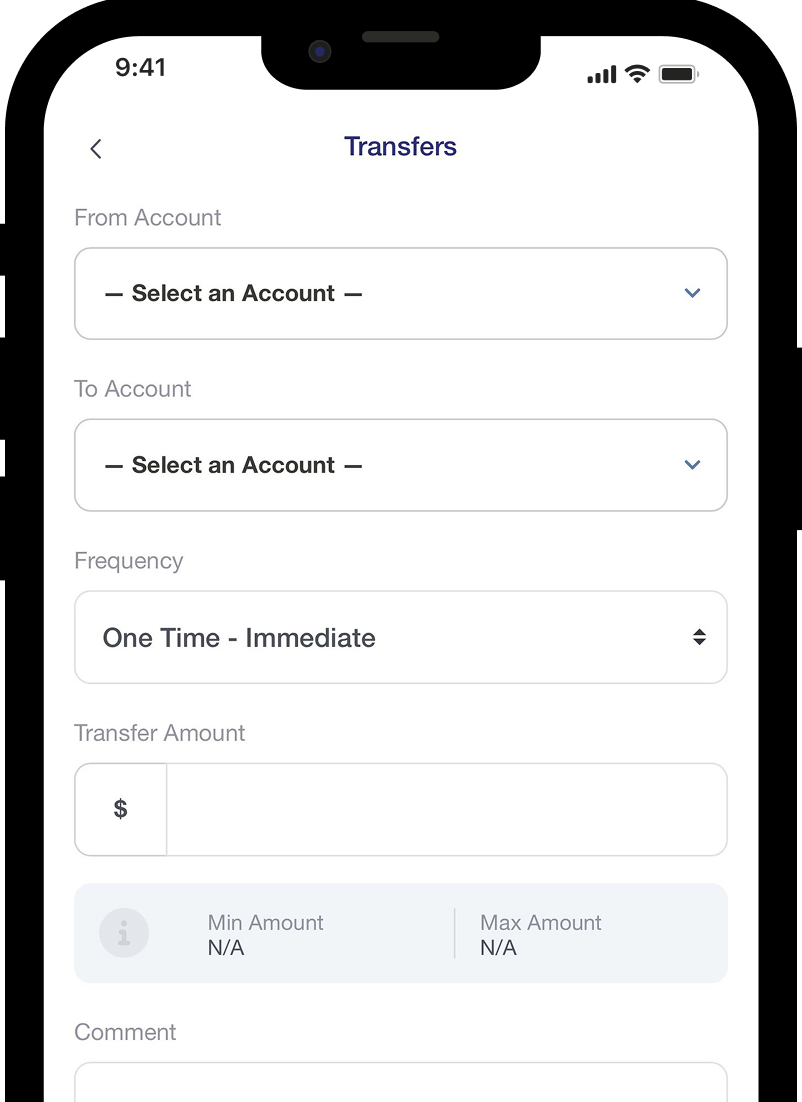

Count on maximum support and convenience with the freedom to manage your debit or credit card online or through our mobile app.

{beginNavtabs}

{endNavtabs}

Tap into our blog posts to gain an upper hand on managing your finances and learn more about banking.